When it comes to financial markets, trading opportunities abound in various forms. Forex trading has long been a popular choice for individuals seeking to invest and profit from the foreign exchange market. However, another avenue that has gained traction in recent years is indices trading. In this blog post, we will explore the world of indices trading, understand its key differences from forex trading, discuss effective strategies, and guide you on choosing a reputable indices trading platform in SA.

What is Forex Trading?

Foreign exchange trading, commonly known as Forex trading, is the act of buying and selling currencies with the intention of making a profit from the changes in exchange rates between different currency pairs. The forex market is decentralised and operates 24 hours a day, enabling traders from around the world to participate in currency trading.

What is Indices Trading?

Indices trading, on the other hand, involves trading financial instruments that represent a specific group of stocks or securities. These instruments are designed to measure the performance of a particular sector or market as a whole. Popular indices include the S&P 500, Dow Jones Industrial Average, and the FTSE 100. Indices trading provides traders with exposure to the broader market rather than individual stocks.

Difference Between Forex and Indices Trading

While both forex and indices trading offer opportunities for financial gain, they differ in several aspects:

- Trading Instruments: Forex trading involves currency pairs, while online indices trading focuses on trading contracts based on the performance of an index.

- Market Dynamics: The forex market is highly liquid and volatile, with price movements influenced by various economic and political factors. Indices trading in SA is typically more stable, reflecting the overall performance of a group of stocks or securities.

- Trading Hours: Forex trading operates 24 hours a day, five days a week, allowing for continuous trading. Indices trading generally follows the regular market hours of the exchange on which the index is listed.

- Risk and Volatility: Forex trading can be more volatile due to the impact of global economic events and news releases. Indices trading tends to be less volatile since it represents a diversified basket of stocks.

Strategies for Online Indices Trading

When engaging in online indices trading, it is important to employ effective strategies to enhance your chances of success. Here are a few strategies to consider:

- Trend Following: Identify and trade in the direction of the prevailing market trend based on technical indicators and chart patterns.

- Range Trading: Take advantage of price ranges within an index by buying at support levels and selling at resistance levels.

- Breakout Trading: Look for significant price movements that break through key support or resistance levels, signalling potential trading opportunities.

- Fundamental Analysis: Stay updated on market news and economic indicators that can impact the performance of the index, and base your trading decisions on this information.

How to Choose a Reputable Indices Trading Platform in SA?

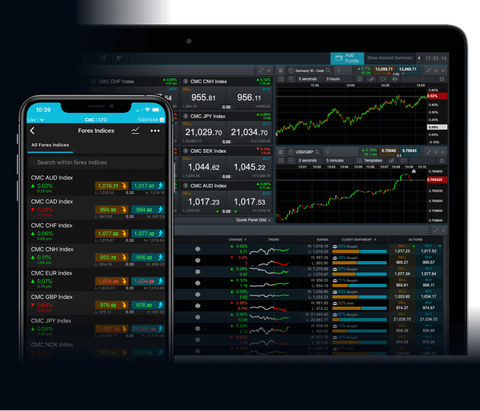

Selecting a reliable and reputable indices trading platform is crucial for a smooth and secure trading experience. Trading platforms like Banxso – Online Trading Platform have these key features.

- Regulation: Ensure that the platform is regulated by a recognised financial authority in South Africa, such as the Financial Sector Conduct Authority (FSCA).

- Security: Look for platforms that prioritise robust security measures, including encryption, two-factor authentication, and segregated client funds.

- Trading Features: Assess the platform’s trading tools, charting capabilities, order types, and execution speed to support your trading strategy.

- Customer Support: Check if the platform offers responsive customer support channels, such as live chat, email, or phone, to address any queries or concerns.

- User-Friendly Interface: Opt for a platform with an intuitive and user-friendly interface, as it can enhance your trading experience and efficiency.

In conclusion,

Forex and indices trading offer opportunities for traders to profit from market movements. Indices trading diversified portfolios and provide stability, while forex trading offers flexibility and volatility. Employ effective strategies tailored to indices trading dynamics. When choosing a platform in South Africa, prioritise regulation, security, and essential features. Understand the differences, employ strategies, choose a reputable platform, conduct research, and refine your skills for successful indices trading. Happy trading!