What is operating cash flow?

CFO stands for “Cash Flow from Operating Activities.” What does this term mean?

The amount of money a business earns from its regular, ongoing operations, such as manufacturing and selling products or providing a service to customers, is known as cash flow from operating activities (CFO). On a company’s operating cash flow statement, this is the first section depicted.

Investment revenue and expense are not included in operating cash flow from operating activities. (Operating cash flow) OCF meaning, or net cash from operating activities, is the primary focus of the CFO.

IMPORTANT THOUGHTS

- For a company’s core business activities, operating cash flow from operating activities serves as a useful indicator of its financial viability.

- Operations and investment and financing activities are both included in this first section of a company’s financial statement.

- Indirect and direct cash flow methods are used on an operating cash flow (OCF) statement to represent cash generated from operating activities.

- It is possible to arrive at a cash basis figure using the indirect method by starting with net income from the income statement and then adding noncash items.

- Using the direct method, all transactions are tracked on a cash basis and the operating cash flow statement is based on actual cash inflows and outflows.

[Also read: Ana Lorde Biography, Wiki, Age, Height, Family, Net Worth]

Operational Activities Cash Flow

Understanding Operational Cash Flow (OCF)

OFC definition, is an essential part of running a business, as it represents the total amount of money that enters and exits a company. To put it another way, it is important for a variety of reasons. With the ability to see where their money is going and how it’s being spent, this tool aids business owners and operators in making smart financial decisions, such as how to best generate and maintain the flow of cash for daily operations and other essentials.

As part of a company’s quarterly and annual financial reports, an operating cash flow statement contains information about the company’s financial health. The ability of a company’s core business activities to generate cash is shown by the operating cash flow from operating activities. In most cases, it incorporates net income as reported on the income statement, as well as any necessary adjustments to move net income from an accrual basis to a cash basis.

An organization can use the cash on hand to do a variety of things, such as invest it in new ventures or product development and launch, buy back shares to demonstrate the strength of their financial position, distribute dividends to shareholders to reward them and boost their confidence, or reduce debt to save on interest payments. Companies whose stock prices are low and whose operating cash flow has shown an upward trend in recent quarters are sought after by investors. The discrepancy indicates that the company is increasing its operating cash flow, which, if better utilised, could lead to higher share prices in the near term.

The fact that the company’s core business activities are generating positive (and increasing) operating cash flow is a good sign. An additional indicator of a company’s profitability potential, in addition to traditional measures such as net income or EBITDA, is provided by this measure.

Statement of Cash Flows

Standard financial reporting requires three main financial statements: the income statement, balance sheet, and operating cash flow statement. There are three parts to the cash flow statement: operating cash flow from operations formula, cash flow from investments, and operating cash flow from financing. Together, the three sections paint a picture of where the company’s cash is coming from, how it is spent, and the net change in cash during a given accounting period.

When it comes to purchasing fixed and long-term assets like PPE and selling them for profit, the cash flow from the investing section shows how much money was spent and how much was made back. When it comes to a business’s financing and capital, the cash flow from the financing section is a good place to start. Financing activities include, for example, the proceeds from the issuance of stocks and bonds, dividends, and interest payments.

Investors use the operating cash flow statement to see where a company’s money is coming from. A company’s operating activities are essential to its success, whereas investment and financing activities may bring in only one-time or sporadic revenue.

Operational Activities Cash Flows

Two options are available for displaying the operating activities cash flow on a cash flow statement.

Using a Side-Chain Approach

Using the indirect method, a company can begin with net income on an accrual accounting basis and work backward to arrive at a cash basis figure for the year. The accrual method of accounting records revenue when it is earned rather than when it is paid out in cash.

Purchasing a $500 widget on credit has resulted in a sale but the money has yet to be received. However, the company continues to record these sales as revenue and records them as net income on its balance sheet in the month of the sale.

The cash basis overstated net income by this amount. Accounts receivable on the balance sheet would reflect the $500 revenue offset. As a result of this sale, there is a $500 increase in accounts receivable on the company’s cash flow statement. It would appear as “Increase in Accounts Receivable -$500” on the cash flow statement.

[Also read: Danii Banks- A Brief Biography and Wiki]

Direct Approach

It’s also possible to use the direct approach, where a business records every transaction on a cash basis and then uses that information to produce an income statement that reflects the actual cash flows that took place throughout an accounting period.

Operational activities can generate direct cash flows, such as:

- Wages paid to workers

- Invoices for goods and services from vendors and suppliers

- Amounts received as payment from clients

- Earned interest and dividends

- Taxes and interest have been paid.

Direct vs. Indirect Approach

The indirect method is more popular among accountants because it makes preparing the cash flow statement using information from the income statement and balance sheet simple. Since the accrual method of accounting is used by the majority of businesses, the income statement and balance sheet will reflect the corresponding figures.

The direct method is recommended by the Financial Accounting Standards Board (FASB) because it provides a more accurate picture of a company’s cash inflows and outflows. Although the direct method is more straightforward, the FASB mandates that companies that use it must also disclose the net income to cash flow from operating activities reconciliation that would have been included in the statement if the indirect method had been used instead.

Similar to the indirect method, the reconciliation report is used to verify the accuracy of the cash from operating activities. The net income is listed first, after which noncash transactions and changes to the balance sheet accounts are taken into account. Companies dislike the direct method because of the additional work it entails.

How to calculate operating cash flow

Operating cash flow formula using the Indirect Method

Different companies and reporting entities have different reporting standards, which can lead to different indirect method calculations. The CFO value can be calculated using one of the following operating cash flow formulas, both of which yield the same result.

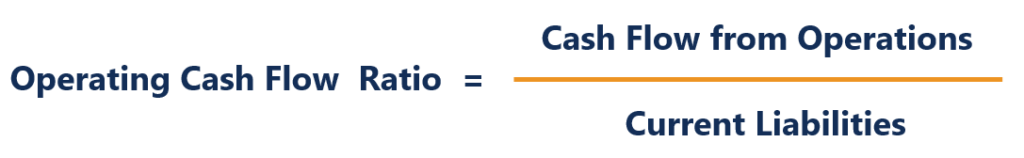

(Operating cash flow) OCF formula:

Operating cash flow calculator:

Cash Flow from Operating Activities = Funds from Operations + Changes in Working Capital

where, Funds from Operations = (Net Income + Depreciation, Depletion, & Amortization + Deferred Taxes & Investment Tax credit + Other Funds)

This format is used for reporting Cash Flow details by finance portals like MarketWatch.

Or

Cash Flow from Operating Activities = Net Income + Depreciation, Depletion, & Amortization + Adjustments To Net Income + Changes In Accounts Receivables + Changes In Liabilities + Changes In Inventories + Changes In Other Operating Activities

Finance portals like Yahoo! Finance use this format to report Cash Flow information.

All of the information presented above can be found in the cash flow statements of numerous companies as standard line items.

The income statement is where we get our net income number. Noncash expenses, such as depreciation and amortization, are added back to net income because the income statement is prepared on an accrual basis. In addition, any changes in balance sheet accounts are taken into account when calculating net income.

An organization’s cash flow from operating activities will reflect changes in the value of assets such as inventories, tax assets, accounts receivable, and accrued revenue. Cash flow from operations reflects changes in the value of liabilities such as accounts payable, tax obligations, deferred revenue, and accrued expenses.

Positive changes in assets are subtracted from net income for cash flow calculations each reporting period, while positive changes in liabilities are re-included in net income. Accounts receivable are an example of an asset account that increases when revenue is recorded but not yet received in cash. It’s important to note that an increase in a liability account such as accounts payable is a sign of an unpaid expense.

An example of a company’s cash flow from its operations.

The cash flow of Apple Inc. (AAPL) for the fiscal year ending September 2018 is shown in the following table. Depreciation, Depletion, and Amortization (DDA) accounted for $10 billion, Deferred Taxes & Investment Tax Credit (-32.59 billion), and Other Funds (4.9 billion) accounted for the remaining $59.53 billion in the iPhone maker’s net income.

There is $42.74 billion in the Fund from Operations as a result, according to the first operating cash flow formula. For the same period, the net change in working capital was $34.69 billion. Apple’s Cash Flow from Operating Activities is now $77.43 billion after adding it to the Fund from Operations.

A Yahoo! Finance portal that reports Apple’s FY 2018 net income of $59.531 billion, depreciation of $10.903 billion, adjustments to net income of -$27.694 billion, changes in accounts receivables of $5.322 billion, changes in liabilities of $9.131 billion and changes in inventories of $.828 billion gives the net CFO value as $77.434 billion.

The answer is the same for both approaches.

[Also read: Heidi Grey Biography]

Extra Care Is Necessary

Cash flow from operations is dependent on working capital, and companies can manipulate working capital by delaying supplier payments, accelerating customer bill collection, and delaying the purchase of inventory. This is important to note. All of these strategies help a business keep its money in the bank. A company can also set its own capitalization thresholds, allowing it to set the dollar amount at which a purchase is considered a capital expenditure.

When comparing the cash flow of various companies, investors should keep these factors in mind. Cash flow from operations is more commonly used to evaluate the performance of a single company over two reporting periods rather than comparing two companies in the same industry, even if they are both in the same industry. This is because managers have the ability to manipulate these figures to a certain extent.