All things must be convenient. Without it, customers have little incentive to use a brand.

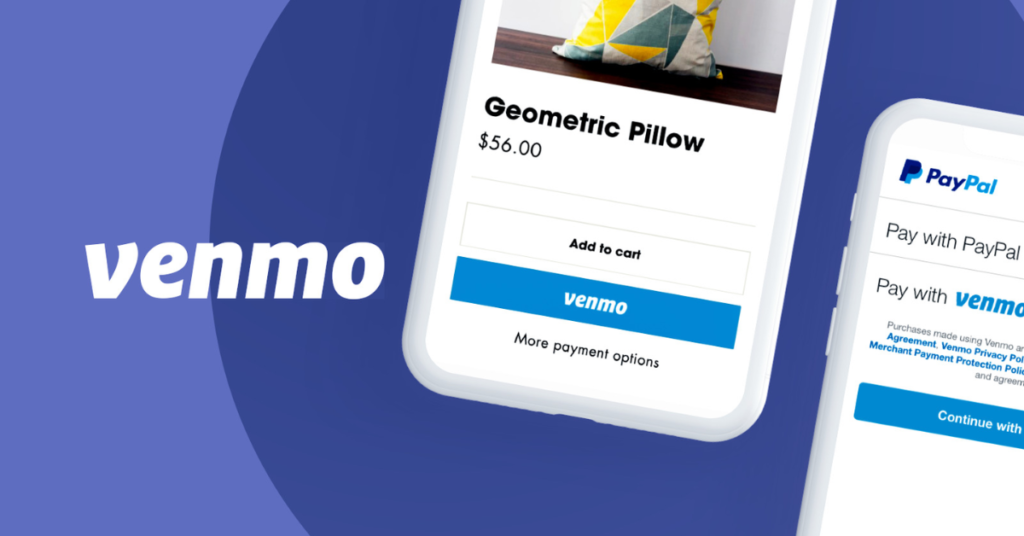

There are numerous methods to make your consumers’ lives more convenient. We’re not referring to trendy terms like variety or customization in today’s post. We’re discussing smart payments, and more specifically, the benefits Venmo can offer your online store.

Venmo, to put it simply, is a mobile payment mechanism that enables users to send and request money from friends and family, as well as use the payment option to make payments on the go to verified merchants. With over 40 million active accounts, the mobile app has grown quickly and exponentially since PayPal purchased Venmo.

According to a recent study, online retailers are where customers most frequently seek the ability to utilize smart or mobile payments. Fast food restaurants, entertainment (think concert tickets), and coffee shops are popular examples of physical sites.

Your business might presently take conventional credit cards, debit cards, and even Apple Pay. Find out what Venmo-like payments through PayPal Checkout with Smart Payment Buttons could accomplish for your online store.

Venmo Overview: Who Uses It and How It Operates

A digital wallet called Venmo first gained popularity among those who wanted a simpler way to send and receive money from friends and family.

Listed below are a few use cases that helped Venmo grow:

- sharing the cost of a meal, especially if the server indicates separate checks are not done.

- paying your share of the rent or utilities for your roommate.

- sending cash as a surprise to a friend to purchase a morning coffee.

How Does Venmo Work?

So, exactly how may Venmo be used to manage peer-to-peer payments from a mobile device? Actually, it’s quite easy. You can accept or send payments after setting up a Venmo account and connecting it to your bank account.

Users of Venmo have choices for sending, spending, and transferring funds, much like those who have a PayPal account. Users of Venmo can transfer funds from their account to U.S. bank accounts or qualifying debit cards, give money to friends and family, use the Venmo Mastercard to make purchases, or shop at any of the millions of retailers who accept Venmo.

It’s critical for your online business to plan how to integrate Venmo into your store’s functioning as the payment option gets more and more popular among consumers. In fact, the vast majority of retailers in North America now accept mobile POS payments or intend to do so in the next two years.

Owners of PayPal businesses are already in a superior position.

Customers can use PayPal Checkout with Smart Payment Buttons or the Braintree payment platform to make their preferred mobile payment in just one simple step.

Venmo: Who Uses It?

Users of Venmo come from many walks of life, although millennials make up the majority of their user base. Millennials adore Venmo for a number of reasons.

The first is that Venmo is a technologically advanced method of payment that enables users to conduct business through a variety of channels, including the Venmo app (available for both iPhone and Android), merchant payments through PayPal Express Checkout, business accounts, and more.

Peer-to-peer payments were first personalized by the app Venmo. How so? Users have the option to include a message with their payments that can be sent to friends in private or publicly. These messages frequently contain a variety of emojis and humorous observations.

Read more about TommyInnit

Read more about Eva Elfie

Payment Delays for Sellers and Businesses

Payment Holds

What are the holds on payments?

Venmo uses payment holds, a standard industry practice, to promote safety for both buyers and sellers on our platform. These holds offer a quick way to settle disputes over qualified payments because there is some inherent risk involved with selling goods and services online. This approach also makes it simpler for business owners and sellers to return funds when a client needs to be refunded.

Businesses and sellers should anticipate the cash to be available in their Venmo accounts (without the company transaction charge or seller transaction fee) in 21 days or less while payment is on hold.

What results in a payment being put on hold?

Your payment might be delayed for a number of reasons. Here are a few typical reasons:

- You have either just started selling on Venmo or you are an experienced seller who has just launched a new account.

- For your selling pattern, the payment you received can be seen as unexpected.

- For a while, your account was inactive.

- You are offering clients a good or service that might lead to their displeasure.

- Numerous clients complained or asked for refunds.

[You can Read About- Johnny Sins Bio]

How will I be able to tell if my payment is being held?

You will be informed in the payment confirmation email if you receive a payment that has been delayed. Your personal transactions feed under the “Me” tab also shows held payments with a small “On Hold” logo, and the held amount is displayed at the top of that page.

Bank Return Venmo Payment

Did a problem occurred that prevented your Venmo payment? To find out the possible causes of your problem, keep reading.

Why will my payment not process?

The following are a few typical reasons why Venmo payments fail:

- Outside of Venmo, your bank or credit card provider rejected the transaction. Due to the payment attempt, one of Venmo’s automated security flags has been raised.

- Contact your bank or the card issuer directly if you’re making a payment using a credit card, debit card, or bank account (the fastest way to reach them is by calling the number on the back of your card). If the transaction is being refused by your bank or credit card issuer, Venmo is unable to influence the decision or determine the specifics of the decision.

Alternate payment methods, such as a different card or bank account, can also be tried.

You might try making the payment once more at a later time if you’ve checked with your bank or card company. If it’s urgent or if you keep having issues, try using another payment processor, such PayPal, our parent company.

Are venmo payments guaranteed?

Venmo payments are generally considered secure and reliable, however, they are not guaranteed. Venmo uses various security measures to protect users’ transactions, but there is always a risk of fraud or unauthorized transactions. Additionally, Venmo is a peer-to-peer payment service, meaning that transactions between individuals are not covered by the same protections as traditional bank transfers. Venmo also has a dispute resolution process in place for resolving any issues with a payment, but it can take time to resolve disputes and recover funds. To ensure the security of your transactions, it’s important to follow best practices such as never sending money to someone you don’t know, and keeping your account secure with a strong password.