An essential indicator in determining the health of your company and the reasoning behind your sales plans and budget is the return on sales (ROS). As a percentage, it illustrates how much of your total income goes toward profit and how much goes toward operational expenditures.

Because a greater ROS ratio equals more profit, you want it to rise over time. Your ROS is a vital data point for your company to track, so let’s delve into how you can calculate return on sales for your business and what the figure is utilized for.

What is ROS in Finance and how to Calculate Return on Sales

Divide your operational profit by your net sales revenue to arrive at your return on sales. Consider a scenario in which your company made $500,000 in sales and spent $400,000 on operating expenditures over the most recent three-month period.

What is return on sales? The first step in figuring out your return on sales is figuring out your income, then removing your costs. Using this scenario, you’d make $100,000 in profit. The ROS is calculated by taking your $500,000 in total sales and dividing it by.20, which gives you a profit margin of 20%.

ROS is normally reported as a percentage, so in this scenario, you would multiply that final value by 100 and use that to record your ROS—in this example, it would be 20%.

That percentage reflects how many pennies you generate in profit for every dollar you earn in sales. For every $1 invested, you’d get $20 in ROS finance.

[Also read: Operating Cash Flow Formula, Definition, and Examples]

Return on Investment (ROI)

For ROS calculation, remove your costs from your revenue and divide that amount by your revenue.

(Revenue less expenses) / Revenue is the formula for calculating the return on sales profit margin calculation method to calculate return on sales, subtract your expenses from your revenue and divide that figure by your revenue.

Return on Sales Formula:

Return on Sales = (Revenue – Expenses)/Revenue or Net Income / Sales

What does ROS stand for? For what reasons is it critical to have a positive ROS?

Return on sales is one of the easiest metrics for evaluating a company’s overall success. In the eyes of investors and creditors, the statistic gives an accurate picture of a company’s reinvestment potential, capacity to repay debts and possible dividends.

ROS is also a good metric to use when comparing one year’s performance to the previous one. For this reason, more revenues may not be the most reliable indicator of a company’s profitability.

However, return on sales is a combination of income and costs. It provides a more realistic view of the company’s performance by allowing firms to see how the two statistics interact.

In addition, it may be used to compare the achievements of various businesses. It’s worth noting, though, that ROS can vary substantially from one sector to another. A meaningful comparison between two enterprises can only be made if they operate in similar markets. A reasonable return on sales ratio is often between 5% and 10%, although the greatest ones may go much higher.

[Here you can also Read about Tommyinnit Biography]

[Here you can Read about American Model Ana Lorde]

How to Boost the Profitability of Sales

The only way to get a better return on sales is to widen the gap between your income and the costs of producing your goods. That may be done in a variety of ways.

Price your Stuff more Expensively.

In terms of increasing sales returns, this may be the simplest method – or at least the one you have the greatest influence over. However, in this context, “straightforward” does not imply “easy.” To be successful, it needs a great deal of thinking and market study.

Taking this path might backfire on you just as quickly. Increasing your pricing too much will result in lower sales and a worse return on sales than you started with if you weaken your market position or alienate your existing customer base.

To save money on your product Inventory or Supplies, look for Discounts and Price Cuts.

By focusing on your expenditures, you can maximize your return on sales. This is one option to consider if you’re afraid to boost your pricing. See if you can get a better deal on your product inventory or supplies by contacting your suppliers.

Don’t be afraid to check out other sellers to see if they’ll drop their pricing if the original one won’t. Strive for discounts that have a significant influence on your manufacturing costs while having no negative impact on your income stream, although this is easier said than done.

Reduce the Number of steps involved in making or Selling your goods.

This is another approach organizations may utilize to save expenses and increase profits. A dangerous, demanding, and at times the morally questionable path to follow. Some employees may have to be laid off as a result of a reduction in production or sales.

As a result, you must be extremely careful and ensure that any changes in the way you pay your staff or the expectations you place on them will not negatively affect overall productivity. It is essential that you maintain a steady stream of income in order for this strategy to function.

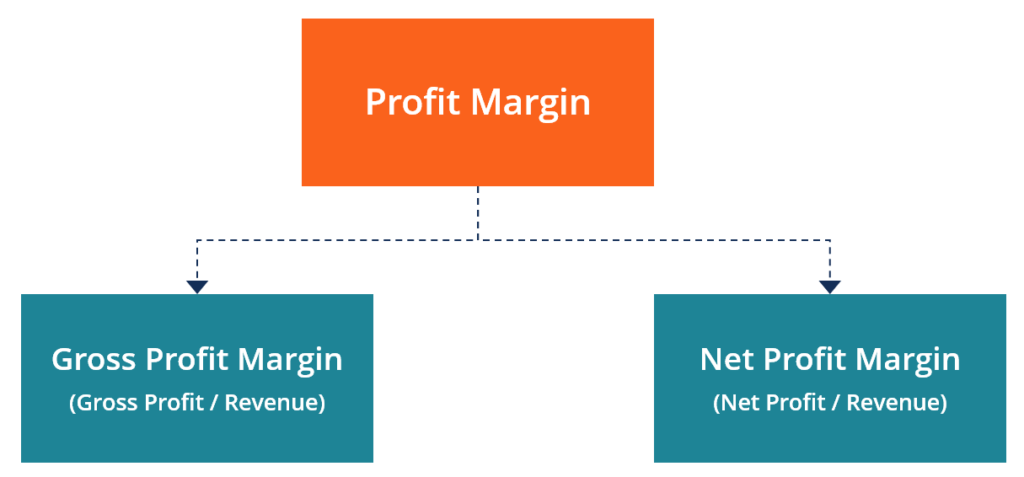

Profit Margin vs. Return on Sales

ROS model (Return on sales) and profit margins are commonly used interchangeably, however, these semantics are only partially correct. Only one type of profit margin is the same as a ros company.

The Percentage of Net Profits that go to Shareholders.

Profit margin (also known as the rate of return on net sales) is a price-to-revenue ratio that compares profit to total sales revenue. The net profit after tax of a business is divided by the entire net sales value to arrive at this number. A net profit margin of 1.5 or 150 percent would be achieved if your firm made $150,000 in profits after taxes and made $100,000 in net sales.

Businesses can compare their performance over time using net profit margin as a measure. Look back at your company’s performance with this number in mind.

How to find Gross Profit? Percentage point Increase in Gross Profit

Calculating a company’s gross profit margin is as simple as dividing revenues by the total cost of all things sold, which may be done in two ways: After subtracting $20,000 from $50,000, divide $30,000 by $50,000 to get a gross profit margin of.6 or 60 percent.

Gross Profit: (Revenue/Total Cost)

GPM is commonly used to compare the profitability of different businesses. It’s an excellent approach to see how well a firm is doing compared to its rivals in terms of profitability.

Profitability as a Percentage of Revenue

Return on sales (ROS) is another term for operating profit margin. To ascertain this number, use the ROS equation.

Calculator for Return on Investment

An essential indicator, return on sales may be used in a variety of ways. With your business, you need to have an image of yourself in order to succeed. You should know what ROS technology is and how to calculate revenue if you want to know how effectively your company is producing a profit.

How to find Total Revenue?

Understanding total revenue will help you make more accurate financial decisions. The total number of units sold and the average price per unit sold are two easy ways to figure out your company’s total revenue. These two factors determine your total revenue. Simply multiply the total number of units sold by the average price per good to arrive at your total revenue. Including interest or dividends in your total revenue is a good rule of thumb.

[Also read: Heidi Grey Biography]

[Here you can Read the Best time to post on Tik Tok]

When calculating your company’s total revenue, use the following formula:

Revenue calculation: (number of units sold)

Substituting the average price per unit sold for the average price per service sold is a good way to improve your service-based business’s profitability. For instance:

(Average price per Service Sold) x (Total Revenue) (Number of Services Sold)

Your total revenue is the result of these calculations. Even the smallest changes in your company’s finances should be accounted for, no matter how insignificant.

It’s important to take into account any price changes that may affect your calculations, such as a price increase for a product or service. Consider any non-operating revenue, such as investment gains or dividend income, when calculating your net profit or loss.